by admin | Jun 29, 2024 | Commercial Real Estate, Residential Real Estate

ChatGPT

Sharon Kantor Bogetz recently completed an intensive 4-day CCIM course focused on Market Analysis in Commercial Real Estate. This comprehensive training focused on key sectors including Retail, Office, Multi-family, and Industrial properties.

Sharon’s commitment to continuous learning sets her apart in the competitive field of commercial real estate. The CCIM course has equipped her with advanced tools and insights, providing her clients with significant advantages in their real estate ventures.

Sharon excels in guiding clients through the due diligence process, ensuring they make informed decisions regarding purchases, investments, and leasing opportunities. Her expertise spans financial analysis, strategic planning, and marketing, as well as psychographic (lifestyle) demographics. These skills enable her to identify and secure optimal commercial opportunities for her clients.

Sharon’s proficiency in market analysis empowers her to deliver unparalleled service. Her clients benefit from her ability to strategically assess the potential of various properties, giving them a competitive edge in the fast-paced markets in Chicagoland and Northwest Indiana.

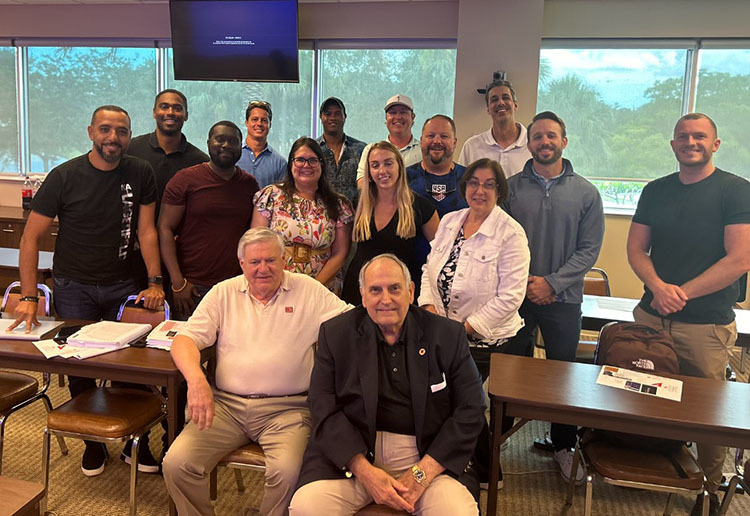

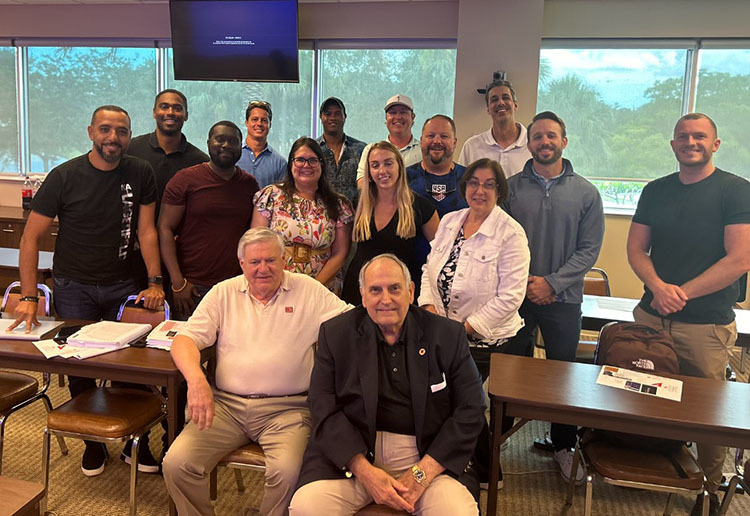

Pictured here with her instructors and some of her classmates, Sharon exemplifies dedication to professional growth and excellence. Her ongoing commitment to education further cements her reputation as a leading commercial real estate expert.

As Sharon continues to enhance her knowledge and skills, she remains a trusted advisor in navigating the complexities of the commercial real estate market. Her clients can be confident that they are working with a professional who is not only up-to-date with industry trends but also adept at leveraging this knowledge to their advantage.

by admin | May 27, 2024 | Commercial Real Estate

Are you a business owner or healthcare provider looking to expand, relocate, or optimize your commercial space? As a Century 21 Commercial real estate broker, I specialize in connecting business owners and practice owners with the right property to achieve their goals.

Licensed in 2019, I am an experienced commercial real estate broker with a deep understanding of the local markets and can guide you through every step of the process, from a property search to lease negotiation or building purchase.

Recent Success Story: My client saw that her patient population was moving from Chicago to the suburbs. I helped her find and open a second practice location in a busy shopping center that perfectly fit the needs of her patient base. This new location also attracted a new group of patients who were looking for a local female dentist in Arlington Heights.

Ready to take your business to the next level?

Contact me, Sharon Kantor Bogetz and get started today. I am a full-time real estate broker who works 7 days a week!

by admin | Apr 28, 2024 | Commercial Real Estate

Sharon received an award for 2022 and 2023 as a top producer at Century 21 Universal. The award was given by Century 21 executives.

by admin | Mar 27, 2024 | Commercial Real Estate

Prime Commercial Rental Opportunity: Ideal Corner Location in Lincoln Square

Positioned at the bustling intersection of N Western Ave, Lincoln and Ainsle, this exceptional 1,250 sq ft space in Lincoln Square is a commercial rental unit offering an unparalleled opportunity for businesses seeking prominence and visibility. Strategically situated at a stoplight and directly across from St. Matthias School and McDonald’s, the property boasts a highly coveted location that guarantees a steady flow of pedestrian and car traffic throughout the day. Beautiful and clean office with 3 closed door rooms with privacy windows in each room. ADA compliant restroom. Room for expansion. Call to schedule your appointment to see this commercial unit at 4857 N Western Ave in Chicago.

by admin | Mar 8, 2024 | Commercial Real Estate

A great way to decrease your construction timeline and reduce your start-up costs is to try a vacated dental office space. I have worked successfully with several dental clients who have had a great experience buying a dental office building or moving into a dental office rental unit. I can show you dental office space in Chicago, Elmhurst, St Charles, Westchester, Buffalo Grove, Geneva, Oak Brook, Naperville, Niles, Northbrook, Schaumburg and Villa Park.

This option will work if you are doing a start-up, practice re-location or a new location for your dental practice. Contact me today at 847-370-9131 to get more information and to schedule a site visit or click here…

I have done more dental office start-ups than any other consultant in the Chicagoland area!

by admin | Dec 18, 2023 | Commercial Real Estate

There is still time to list your dental practice and dental building before the 2024 Chicago Midwinter Meeting. The Chicago Midwinter Meeting at McCormick Place is still 10 weeks away. I will be in Booth 1102 on the Exhibit Floor this year. We have an email list of more than 200 dentists eager to find a practice to purchase, a dental building to buy or rent. Call today for your free no-obligation private consultation. Take advantage of doctors looking to purchase a dental practice at the Midwinter Meeting. Call 847-370-9131.